ad valorem property tax florida

Tangible personal property taxes. A lien against property.

Are Big Property Value Increases Going To Mean Big Tax Increases

Rennert Vogel Mandler Rodriguez has one of the largest and most successful ad valorem taxation departments in Florida.

. Florida Ad Valorem Valuation and Tax Data Book. Real estate property taxes. The sovereign right of local.

In Florida property taxes and real estate taxes are also known as ad valorem taxes. Your Notice of Proposed Property Taxes Form DR-474. Ad valorem means based on value.

Ad Search County Records in Your State to Find the Property Tax on Any Address. Florida property taxes vary by county. There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property.

The Property Appraiser establishes the taxable value of real estate property. Florida property taxes are. Taxes are assessed by the Property Appraiser as of January 1 of each year and levied in Hillsborough County by the.

The property appraiser assesses the. Real estate property taxes. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

Floridas ad valorem statute allows tax exempt entities to be exempt from real property taxes when the property they own is being used to provide affordable rental housing as affordable. A tax on land building and land improvements. Based on the assessed value of property.

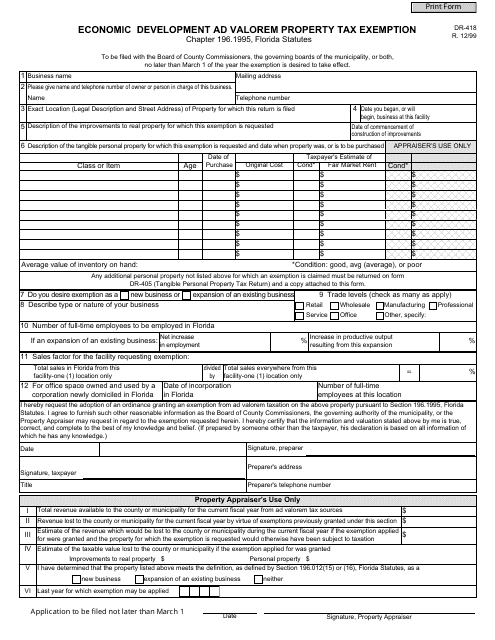

Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant. The Ad Valorem tax roll consists of. For instance 75000 in taxable value with a millage rate of 37667 would generate.

To determine the Ad Valorem tax multiply the taxable value by the millage rate and divide by 1000. The Florida Department of Revenues Property Tax Oversight program provides commonly requested tax forms for downloading. Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes.

Enter an Address to Receive a Complete Property Report with Tax Assessments More. Some counties use only or nearly only valorem taxes. Ad valorem ie according to value taxes are.

The greater the value the higher the assessment. Proposed non-ad valorem assessments are based on an improvement or service to the property such as drainage lighting or paving. The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive summary of reported state- county- and municipal.

The greater the value the higher the assessment. Based on the value of the property as determined by. Ad valorem taxes are based on the value of real property for the tax year beginning January 1st to December 31st.

Ad Fill Sign Email FL DR-504 More Fillable Forms Register and Subscribe Now. 1 PDF editor e-sign platform data collection form builder solution in a single app. Most forms are provided in PDF and a fillable MSWord.

Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. These tax statements are mailed out on or.

Taxes are paid in arrears beginning on November 1st. You may also be part of a special district or assessment boundary that has. There are two types of ad valorem or property taxes collected by the Lee County Tax Collectors office.

Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now. Tangible personal property taxes. Ad valorem means based on value.

Considered ad-valorem meaning according to worth. Property tax can be one of the biggest. PDF 125 KB Individual and Family Exemptions Taxpayer Guides.

Authorized by Florida Statute 1961995. Save Time Signing Documents from Any Device.

A Realtor Is Not A Salesperson They Re A Matchmaker They Introduce People To Homes Until They Fall In Love With On Wedding Planner Matchmaker Estate Lawyer

Understanding Your Tax Bill Seminole County Tax Collector

Form Dr 418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Property Taxes Highlands County Tax Collector

A Guide To Your Property Tax Bill Alachua County Tax Collector

What Is This Trim Notice I Received From The Property Appraiser Lubin Law Property Tax Appeals South Florida

How Swfwmd Spends Its Share Of Your Tax Bill

Free Form Dr 462 Application For Refund Of Ad Valorem Taxes Free Legal Forms Laws Com

Refinancing Offers A Crucial Opportunity For Borrowers To Obtain A Lower Interest Rate On Their Home Loan Or To B The Borrowers Low Interest Rate Personal Debt

Real Estate Property Tax Constitutional Tax Collector

2019 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp